All Categories

Featured

Table of Contents

- – Superior Accredited Investor Investment Opport...

- – Professional Accredited Investor Investment Funds

- – World-Class Accredited Investor Property Inve...

- – Accredited Investor Real Estate Deals

- – Sought-After Accredited Investor Investment ...

- – In-Demand Accredited Investor Opportunities

- – Sought-After Accredited Investor Growth Oppo...

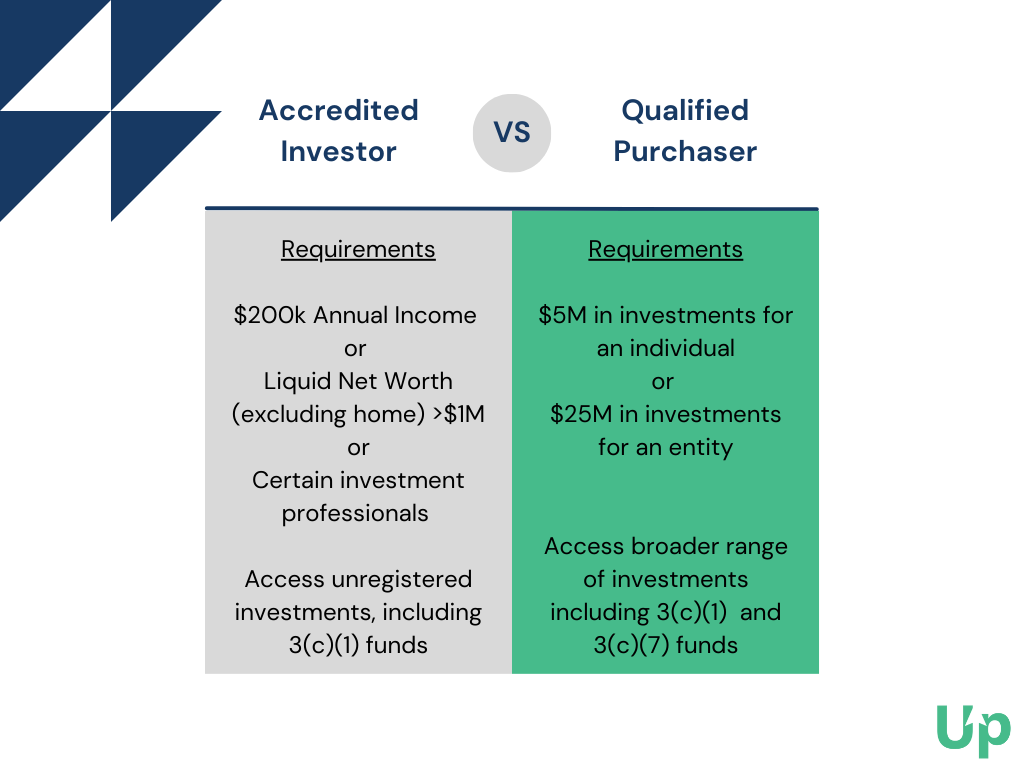

The policies for certified financiers differ amongst territories. In the U.S, the definition of a recognized capitalist is presented by the SEC in Guideline 501 of Regulation D. To be a certified financier, an individual needs to have an annual revenue going beyond $200,000 ($300,000 for joint earnings) for the last 2 years with the assumption of gaining the same or a greater income in the existing year.

This amount can not include a key residence., executive officers, or supervisors of a business that is issuing non listed safety and securities.

Superior Accredited Investor Investment Opportunities

If an entity is composed of equity proprietors who are certified investors, the entity itself is an accredited financier. Nevertheless, a company can not be created with the single objective of buying specific protections - passive income for accredited investors. An individual can certify as an accredited investor by showing sufficient education and learning or work experience in the financial market

Individuals who intend to be accredited capitalists don't put on the SEC for the designation. Rather, it is the responsibility of the company supplying a personal positioning to make certain that every one of those approached are accredited investors. Individuals or events who intend to be approved investors can come close to the company of the non listed securities.

As an example, mean there is a specific whose income was $150,000 for the last 3 years. They reported a key home value of $1 million (with a home mortgage of $200,000), an auto worth $100,000 (with an exceptional finance of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Total assets is computed as assets minus liabilities. He or she's internet worth is precisely $1 million. This involves a calculation of their possessions (apart from their primary house) of $1,050,000 ($100,000 + $500,000 + $450,000) less an automobile finance equating to $50,000. Considering that they fulfill the total assets demand, they certify to be an accredited capitalist.

Professional Accredited Investor Investment Funds

There are a few much less common credentials, such as taking care of a count on with more than $5 million in possessions. Under government safeties legislations, only those who are certified investors may join specific securities offerings. These may include shares in private positionings, structured products, and personal equity or hedge funds, to name a few.

The regulators want to be particular that individuals in these extremely high-risk and complex investments can take care of themselves and evaluate the risks in the absence of government protection. The accredited financier guidelines are created to protect potential investors with minimal monetary understanding from adventures and losses they might be unwell outfitted to endure.

Recognized capitalists satisfy certifications and professional standards to accessibility special investment possibilities. Recognized investors need to satisfy earnings and internet worth demands, unlike non-accredited individuals, and can spend without limitations.

World-Class Accredited Investor Property Investment Deals

Some essential modifications made in 2020 by the SEC consist of:. This change acknowledges that these entity kinds are commonly utilized for making investments.

This adjustment accounts for the results of inflation with time. These changes broaden the accredited investor swimming pool by approximately 64 million Americans. This bigger gain access to supplies more chances for investors, however also raises potential dangers as less economically sophisticated, investors can participate. Organizations making use of personal offerings might profit from a larger swimming pool of possible investors.

These financial investment alternatives are special to accredited financiers and organizations that qualify as a certified, per SEC guidelines. This gives accredited investors the opportunity to invest in arising business at a stage prior to they take into consideration going public.

Accredited Investor Real Estate Deals

They are considered as financial investments and come only, to qualified clients. Along with well-known business, certified financiers can select to invest in startups and promising ventures. This offers them income tax return and the opportunity to go into at an earlier phase and potentially reap rewards if the firm flourishes.

For financiers open to the threats entailed, backing start-ups can lead to gains (accredited investor investment opportunities). Most of today's technology firms such as Facebook, Uber and Airbnb originated as early-stage startups sustained by approved angel investors. Advanced financiers have the opportunity to explore financial investment options that might yield much more profits than what public markets provide

Sought-After Accredited Investor Investment Networks

Although returns are not guaranteed, diversity and profile improvement options are expanded for capitalists. By diversifying their portfolios with these broadened investment methods approved financiers can boost their approaches and possibly achieve remarkable long-lasting returns with appropriate danger administration. Seasoned capitalists commonly experience investment choices that might not be quickly offered to the basic financier.

Financial investment choices and safeties supplied to approved financiers normally entail greater threats. As an example, personal equity, financial backing and hedge funds often focus on buying properties that bring danger however can be liquidated quickly for the possibility of higher returns on those dangerous investments. Investigating prior to investing is vital these in scenarios.

Lock up periods stop financiers from withdrawing funds for more months and years on end. Financiers might struggle to precisely value exclusive assets.

In-Demand Accredited Investor Opportunities

This adjustment might prolong recognized investor standing to a variety of people. Allowing companions in committed partnerships to incorporate their resources for shared eligibility as certified financiers.

Enabling individuals with particular expert certifications, such as Collection 7 or CFA, to qualify as certified investors. This would certainly acknowledge monetary sophistication. Developing added demands such as proof of financial proficiency or effectively completing a certified investor test. This could make sure financiers comprehend the threats. Restricting or removing the key home from the total assets calculation to minimize potentially filled with air evaluations of wealth.

On the various other hand, it can additionally result in skilled capitalists assuming excessive risks that may not be suitable for them. Existing certified financiers may encounter raised competition for the ideal investment possibilities if the pool grows.

Sought-After Accredited Investor Growth Opportunities

Those who are currently considered accredited investors should remain upgraded on any modifications to the criteria and laws. Their eligibility could be based on modifications in the future. To preserve their standing as accredited financiers under a modified definition changes may be required in riches management tactics. Services seeking accredited capitalists should stay attentive concerning these updates to guarantee they are attracting the right target market of capitalists.

Table of Contents

- – Superior Accredited Investor Investment Opport...

- – Professional Accredited Investor Investment Funds

- – World-Class Accredited Investor Property Inve...

- – Accredited Investor Real Estate Deals

- – Sought-After Accredited Investor Investment ...

- – In-Demand Accredited Investor Opportunities

- – Sought-After Accredited Investor Growth Oppo...

Latest Posts

Accredited Investor Company

Tax Sale Overages List

Unparalleled Real Estate Overage Funds Learning Overages List By County

More

Latest Posts

Accredited Investor Company

Tax Sale Overages List

Unparalleled Real Estate Overage Funds Learning Overages List By County